August 2020 Fire Report: Hey, Insurance Companies! Not So Fast!

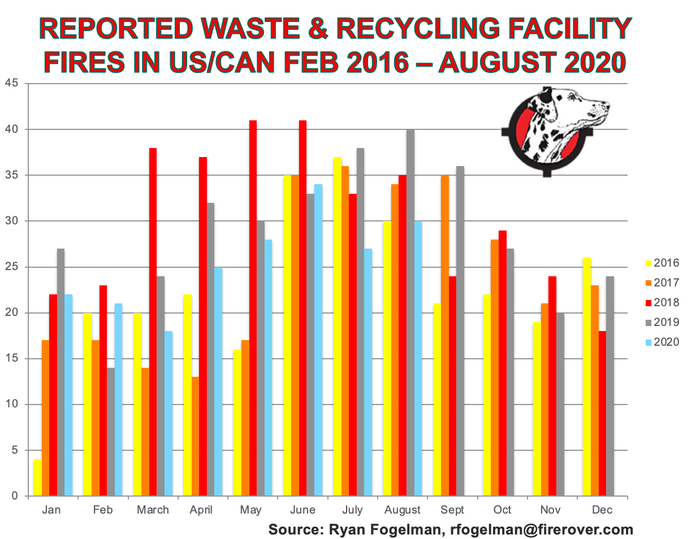

Great news! After last month’s lowest July in terms of reported fire incidents, we had the lowest level of incidents since 2016 for the month of August.

We experienced 30 waste and recycling facility fire incidents this month. The majority of these fires occurred in waste, paper and plastic recycling operations and scrap metal processing facilities. At Fire Rover, we eliminated nine fire incidents at our clients’ operations utilizing our Fire Rover solution, which I outlined in June’s article.

During the past 12 months, the waste and recycling industry has experienced 312 reported facility fires in the U.S. and Canada. We additionally incurred 28 reported injuries and four deaths that can either be directly or indirectly attributed to these fire incidents. Based on reasonable assumptions, we can extrapolate that 1,800-plus facility fires have occurred during that time, which, based on the number of facilities reported by the Environmental Research & Education Foundation, is more than 40 percent of the industry.

I define “reported facility fires” as any fire that has been reported by the media that occurs at a waste or recycling facility in the U.S. and Canada. Typically, the fires that are reported by the media are larger fires that require fire professionals to arrive on the scene and where there are effects that the public can witness.

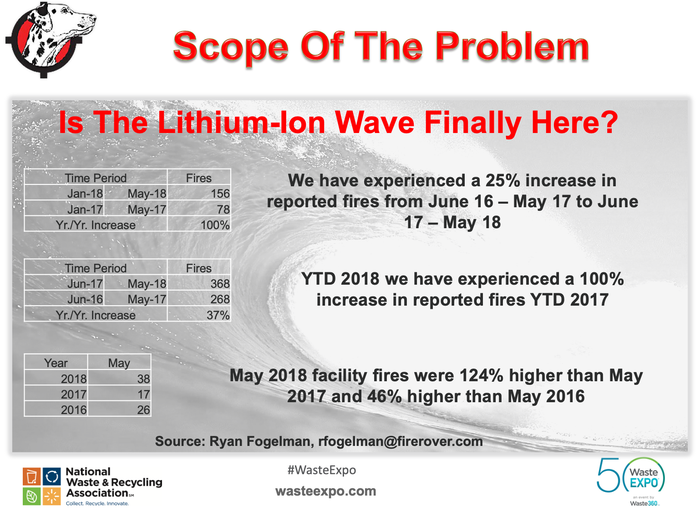

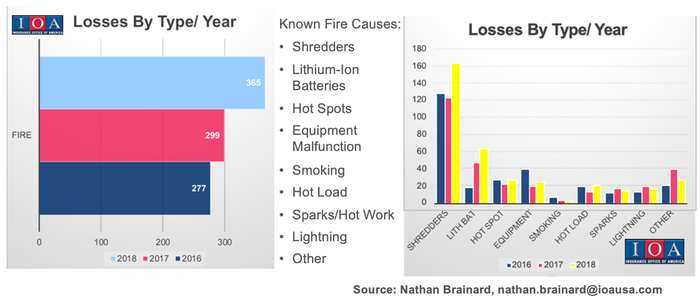

Hindsight is 20/20, but looking back, 2018 turned out to be one of our worst years on record. The truth is that insurance carriers do not care about articles or social media posts regarding risks to their clients’ portfolio assets; they care about the numbers, the actual claims that their clients file for reimbursement. Most of you have seen Nathan Brainard’s numbers from the five biggest insurers at the time for 2016-2018. The numbers show that losses are clearly growing from each year, and losses by type lead to shredder and lithium-ion batteries as the major increases.

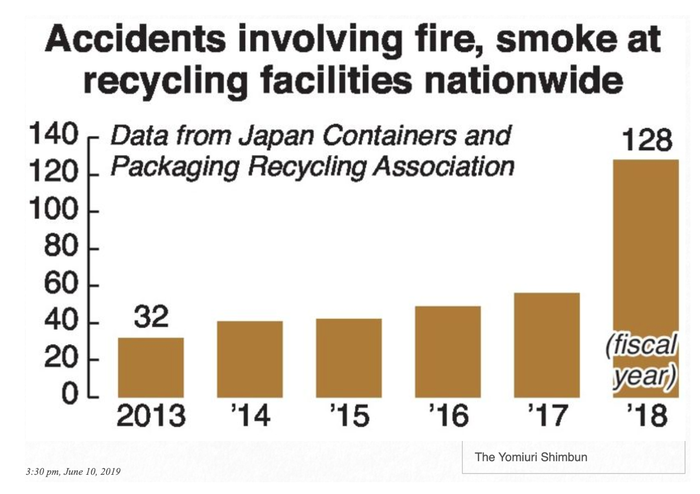

Additionally, the insurers were not just faced with this increase in the U.S.; they were seeing this story play out all over the world. Japan Containers and Packaging Recycling Association, for example, released data from its survey reporting that in fiscal year 2019, recycling facilities for plastic containers reported 230 incidents of smoke or fires by the end of December. The year 2018 saw a more than twofold increase in the number of incidents in waste and recycling facilities. Anecdotal evidence has shown the same for the U.K. and Australia as well.

Most industry folks only see my efforts on the sales side of the business. What most do not see is the countless number of hours I have spent working with insurance companies, brokers, fire protection engineers and more to not only share our story but to educate them on a path forward - a light at the end of the tunnel.

So, in an effort to help mitigate fire risk in the waste and recycling industry to pre-lithium-ion battery levels and better, I’m sharing Fire Rover’s technology and results as well as the extensive amount of work the industry’s operators and associations have put in place in the past five years with regard to fire safety training, disaster response plans, processing “best practices,” educating the public on hazards of not disposing and recycling properly and more.

This goes both ways. The insurance companies that once allowed safety audits that included a “check the box” approach to ensuring plans were “real” and “implemented” are now opening up the hood and ensuring that operations implement and maintain the plans they layout in audits and fulfill any commitments they make.

So, this month, I want to get back to the basics and focus on how we can bring insurers back to the market. Just like they did not leave because of my articles, they are not going to come back because of my articles. They need data and the right strategies in place to give risk managers comfort that writing a policy in our occupancy is not going to be a poor investment or a major risk.

A conversation with Ryan Butler, vice president of risk management at Cottingham & Butler Insurance Services Inc.

Ryan Butler is a VP of Risk Management for Cottingham & Butler. C&B has been around since 1887 and is the 6th largest privately and independently held insurance brokerage firm in the country and has dedicated focus providing safety, claims and insurance services for highly complex and difficult classes of business throughout the US. I worked with Ryan on one of our shared waste and recycling clients and during our interactions, Butler and I got to discussing what is going on with the global insurance industry and what it would take to get back to a healthy insurance marketplace for the waste and recycling industry.

Here’s a short recap of our discussion.

Ryan Fogelman: I am a firm believer that sometimes it takes a fresh set of eyes to develop an innovative approach to a problem. How do you see the current insurance market for the waste and recycling industry?

Ryan Butler: What many people often overlook is how the capital and reinsurance (insurance for insurance companies) markets affect traditional insurance carriers’ ratings and thus the price that waste and recycling companies pay for insurance coverage. Unfortunately, the reinsurance markets have been experiencing more losses, ranging from consistent catastrophic events such as active hurricane seasons decimating the property insurance market to “nuclear verdict” cases in liability suits.

Over the past several years, both reinsurance and traditional insurance carriers have been increasing rates on many high-risk classes of business and focusing intensely on revising their underwriting appetite in order to revive their balance sheets. With that, we are witnessing a growing number of carriers close down large existing portfolios of clients and completely exit certain classes of business that they feel have a higher risk profile. Unfortunately, waste and recycling is one class with a negative reputation across the international marketplace, and, regrettably, we will witness increasing rates and restricted coverages through 2021, especially in specific lines of coverage such as but not limited to auto, property and umbrella.

Ryan Fogelman: It is no secret that insurance carriers have been leaving the waste and recycling industry at a rapid pace since 2017. How do we change the trend?

Ryan Butler: As an industry, we need to continue to improve upon our risk mitigation best practices and implement better loss control and safety programs. Too often operators, insurance brokers and consultants in the sector view insurance coverage as the first line of defense. However, this mindset is flawed and will only cause greater deterioration in the insurance sector for waste and recycling companies.

Insurance coverage is just one element of risk transfer, and it should be viewed as a way to protect operators’ balance sheets for catastrophic events that occur once every two to five years, for example. But that is not all; insurance must be used in conjunction with sophisticated loss prevention measures and advanced proactive risk management programs to help operators reduce their reliance on traditional insurance and to show insurance companies that they are insuring a client that is eager and willing to invest in improving their operations.

As an industry, if we look at insurance as being the issue, the market won’t change. The market trends we are seeing will always ebb and flow, but the operators that will have more control of their insurance spend and stability in insurance carrier options through the next decade are those that are centered around the following strategies: focusing on better controlling the exposures; leveraging specialist insurance brokers and safety to managers such as Cottingham & Butler to help proactively reduce the frequency and severity of losses; and willingness to increase retentions (i.e., higher deductibles).

It is important for the industry that we start focusing on how to improve our loss control measures, so we can eventually change the negative stigma that is currently plaguing the waste and recycling class of business.

Ryan Fogelman: What is driving you to bring your risk mitigation expertise to the industry, and how do you see your solution benefiting our constituents?

Ryan Butler: As we all know, solving insurability, safety and claims issues for the waste and recycling industry has become a very difficult endeavor. As soon as we started seeing the premium inflation, carrier exits and high frequency and severity of losses, we decided to enter this market to support the industry’s insurability and growth by leveraging our company’s unrivaled skill sets and resources.

Foremost, we began to build and train a team of dedicated specialists in waste and recycling, ranging from coverage experts to safety advocates, to loss control professionals, to claims experts, so we could provide a holistic approach to risk management. This specialization and focus have helped our clients take more control over their standard insurance costs and lower the total overall cost of risk over time.

Ryan Fogelman: What are you doing to motivate carriers back into the market?

Ryan Butler: We have two main areas that have been helping us see growth in market appetite. One is the creation of our unique value proposition that helps our clients reduce the frequency and severity of their exposures and develop an optimal insurance program. We wanted to build out a platform that gives waste and recycling organizations the tools and resources needed to improve their operations from a loss perspective and reduce the total cost of risk long term. Articulating these improvements with the insurance carriers helps them better understand the risk and differentiate the waste and recycling organizations that are dedicated to improvement. The second part is having a superior marketplace submission to highlight key areas where risk mitigation practices are in place today, and what the operations will be investing in in the future. Many of the little things waste and recycling organizations do each and every day to mitigate losses are overlooked, and we want to bring these to light.

We need to keep up the good work and continue educating, optimizing processes and investing in technology that will not only make our individual companies safer and more productive but keep our waste and recycling businesses operating and protected from catastrophic losses with healthy insurance options. This is a classic case of if we all do our individual jobs, the greater reward will be a safer and healthier industry. Our industry is critical to our economy, and allocation of the unavoidable risk is necessary, but the avoidable risk simply needs to be avoided.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)