CNG Tax Credit Renewed: What’s the Impact for Solid Waste?

A look at the key points from Stifel’s “CNG Tax Credit Renewed Retroactively—What is the Impact and When” report.

Congress has passed a funding bill that includes renewal of compressed natural gas (CNG) tax credits that expired at the end of 2017. The bill was signed by President Trump on December 20.

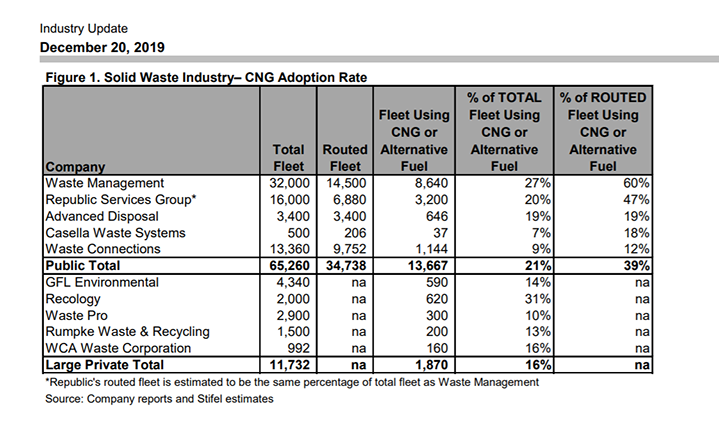

The extension is to 2020 and is retroactive back to the expiration. That means all solid waste companies with CNG trucks operating in their fleet should enjoy a cash tax benefit, according to a report released by Michael E. Hoffman, managing director and group head of diversified industrials at Stifel.

“To be clear, this is millions to up to tens of millions, not hundreds of millions, of incremental cash, and some of it could come in FY19, depending on when the funding bill is signed; otherwise, this will be all booked in 2020,” according to the report.

Here are the key points from Stifel’s “CNG Tax Credit Renewed Retroactively—What is the Impact and When” report:

What is the Tax Credit?

For every gallon of diesel or gasoline replaced in a fleet with CNG, there is a 50-cent-per-gallon tax credit. In February 2018, Congress retroactively extended the tax credit for CNG purchases in 2017. The impact for full-year 2017 was booked in the first quarter of 2018. The credit impacts operating expense and taxes split about 75:25, according to Stifel’s report.

Assuming Trump signs the current government funding bill, CNG fuel purchases in 2018, 2019 and 2020 would be eligible for the 50-cent-per-gallon tax credit. The current extension expires at the end of 2020.

What was it Worth in the Past?

The last time this credit was extended, Waste Management (WM) reported in Q1 2018 a $28 million cash tax benefit. At that time, WM's routed fleet was about 38 percent CNG. Today, it is nearly 60 percent CNG. Neither Republic Services, Waste Connections or Casella Waste Systems have materially changed the mix of CNG in the routed fleet since 2017. At the time, Republic reported a $15 million credit and booked it in Q1 2018. Waste Connections had a roughly $3 million credit and booked it in Q1 2018. Casella had a $1 million credit and booked it in Q1 2018.

According to Stifel estimates, the following is how solid waste companies are impacted by the latest tax credit extension:

Casella Waste Systems: Annual impact is less than $1 million for a total cash benefit of $2 million through 2020.

Republic Services: Annual impact is $15 million for a total cash benefit of $45 million through 2020.

Waste Connections: Annual impact is $3 million for a total cash benefit of $9 million through 2020.

Waste Management: Annual impact is $40 million to $45 million for a total cash benefit of $120 million to $135 million through 2020.

Model Changes

“At this writing, we are not changing our models,” stated Stifel. “However, we would note if FY18 and FY19 are booked in FY19, then Q4 2019 operating margins will be helped as 75 percent of this credit is a fuel cost offset and 25 percent is a tax credit offset. We expect all of the companies would call it out.”

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)