October 2020 Fire Report: Worst October For Fires!

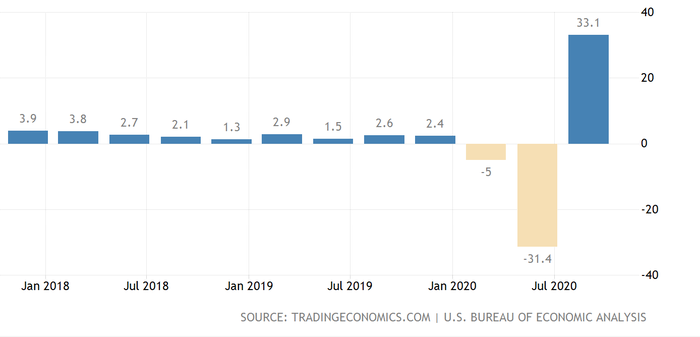

2020 is going down as a “year for the ages” across the globe, and that is certainly true in our waste and recycling operations across the U.S. and Canada. According to the chart below, the U.S. gross domestic product bounced back in Q3 from the historic lows we experienced in the first half of the year caused by the effects of the global pandemic. As highlighted in my earlier articles, the waste, paper and plastic facility fires made up a larger percentage of the total fire incidents each month when compared to historical data, which changed drastically in September with an increased percentage of scrap, construction and demolition (C&D) and e-scrap fires.

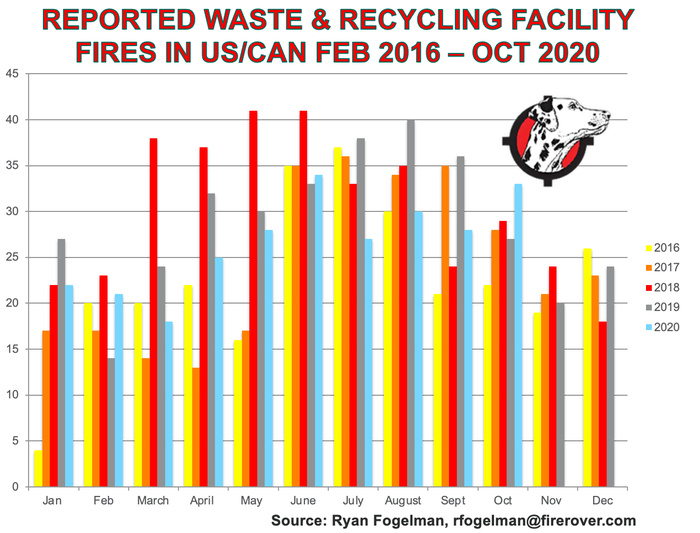

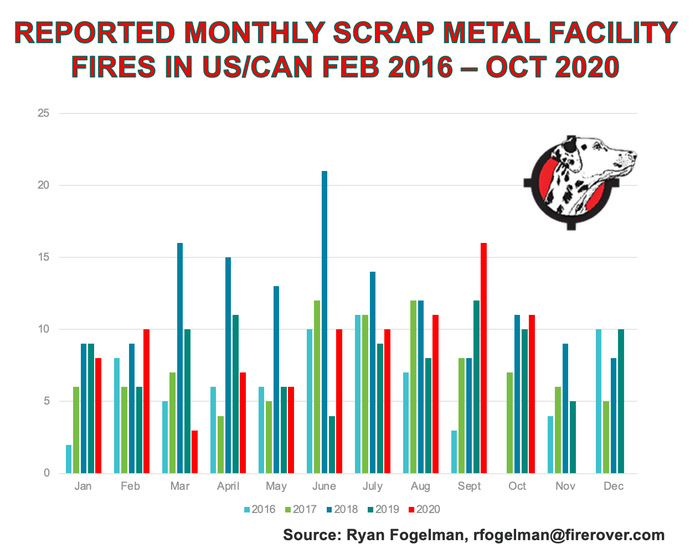

As I showed last month, we have been working to get commercial and industrial business back online, which I believe resulted in a September’s surge in fires at scrap metal facilities. Then comes October, and we experience 33 fires at our waste and recycling facilities—the second-highest month of fires at our waste and recycling facilities this year. Of the 33 fires, 17 were waste fires, 11 fire incidents occurred at scrap metal facilities and the rest were peppered in at C&D, electronic and plastic facilities. At Fire Rover, we extinguished 15 fires at our clients’ facilities; eight of those fires were at metal recycling operations and the rest occurred in waste, C&D, and transfer operations.

During the past 12 months, the waste and recycling industry has experienced 311 reported facility fires in the U.S. and Canada. Additionally, we incurred 18 reported injuries and three deaths that can either be directly or indirectly attributed to these fire incidents. Based on reasonable assumptions, we can extrapolate that 1,800-plus facility fires have occurred during that time, which, based on the number of facilities reported by the Environmental Research & Education Foundation (EREF), is more than 40 percent of the industry. I define “reported facility fires” as any fire that has been reported by the media that occurs at a waste or recycling facility in the U.S. and Canada. Typically, the fires that are reported by the media are larger fires that require fire professionals to arrive on scene and where there are effects that the public can witness.

We Must Face Some Truths

Last month, I highlighted the increase in scrap metal fires and my observations regarding the industry’s response to solve these problems. A number of folks have reached out to me suggesting that a one-month spike doesn’t make a trend. While I agree with that statement, there are clear trends we are all seeing across the industry, and our responses must follow the true scope of the problem.

The fact is we are on trend to have the highest annual scrap fire incidents since 2018, when the industry experienced 145 fires incidents in the US and Canada. The scrap industry has already experienced 92 fire incidents in 2020, surpassing both 2016 and 2017. If we stay on-trend, 2020 will beat 2019’s number by more than 10 percent. Keep in mind that also includes March, April and May numbers that were historically low, assumedly due to the pandemic slowdown.

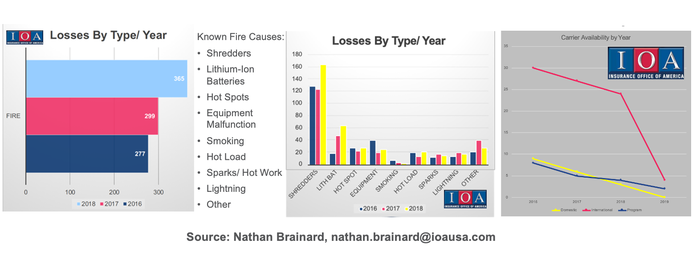

It is not my intention to call out the scrap metal industry, or any industry for that matter, but we cannot hide from the problem, as it gives insurance companies another reason to shy away from our industry. Insurance companies make their underwriting decisions based on real claims data, and they don’t care or listen to the media or anyone else’s opinion.

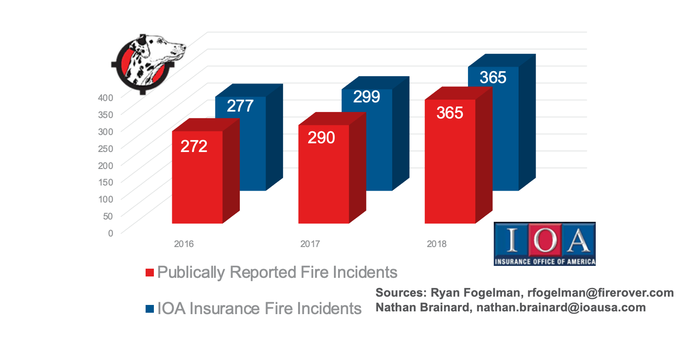

I started talking about the fire epidemic in the waste and recycling industry in 2015, and it took insurers until 2018 to see their claims spike. According to IOA data provided by Nathan Brainard, 2018 was the banner year for claims and consequently insurance companies began to leave the market at a hurried pace. The increases were caused by an increase in lithium-ion batteries in our waste stream as well as in shredders that many would attribute to the additional spark risks causes by the same culprit. As you can see from the data, 2019 was the year that many of the insurance companies decided to leave the industry.

Insurance companies have been running from our industry since 2018, and the only data that caused their exit was their actual claims data! Now, we are seeing higher premiums across the industry, and that trend isn’t expected to go away anytime soon. To win them back we need to make the safety changes to mitigate their risk. The reality is that these changes need to implemented at the site level and the insurability of each site will be evaluated by each insurance company based on a number of factors like historical claims, incident data, response, training, the rest of the sites in a portfolio to name a few.

We Can Bring Insurers Back

We need to focus on bringing the insurance companies back to our occupancy, as I highlighted in August’s article. I have helped a number of insurance companies understand the risk we face in our industry, and as I have been saying for more than five years, good operators definitely have less fires than bad operators. But, when good operators are still having fires, new solutions outside of the basics are needed. We need to continue to implement real fire prevention and disaster response plans at all our facilities. This alone can work in industries where the fire hazard can be removed. In the waste and recycling industry, where good operators still have fires, we need to take more steps to help solve the problem.

Insurance companies want to protect our industry occupancy. According to Ryan Butler, vice president of risk mitigation for Cottingham & Butler, which provides insurance for a number of different high-hazard industries, “Carriers become hesitant to enter or write complex classes of business when they see systemic losses. However, underwriters gain another level of confidence when they see operators investing time, capital and resources into auditing and analyzing their exposures, as this shows there is a wiliness to improve and avoid mistakes. To many people, auditing certain exposures on an annual basis can be a double-edged sword, as there is concern the insurance carrier will penalize and increase rates on any deficiency or issue unveiled during the audit. However, generally it is the exact opposite; when a carrier sees that an operator is investing and openly illustrating issues, and the remediation and capital expenditures that will be undertaken to fix the issues, they will have a different viewpoint and interest in the account.” “If an operator invests in an audit, they will be on the path to better risk management practices, which can actually help them reduce a catastrophic loss,” he added. “It is imperative, irrespective of insurability and coverage options, that operators take the necessary precaution to avoid losses wherever possible, as experiencing a large loss will tarnish the reputation of the business for three to five years.”

The insurance companies do not want to see band-aids or lipstick; they want to see real effort defining the real scope of the problem, solutions and paths forward for strategies that will mitigate the specific risks of the occupancy. If they do not see this, the only thing they have to go in is historical claims data. Fire prevention plans and disaster preparedness plans are the basic “blocking and tackling” strategies insurance underwriters already expect good operators to have in place. If they do not have those in place, they are not considered good operators. The insurance companies want to see operators that will face problems head-on and not try to avoid them and wish they would just go away.

I have been presenting my data, which comes from reported media outlets, since 2016, and many folks have made clear that they do not believe you can trust my numbers. The only reason I began this initiative was because there was virtually no publicly available fire incident data in the U.S. and Canada. The little data there came from European companies and informal statistically insignificant surveys in North America. Imagine how I felt when Nathan Brainard, vice president, environmental division of Insurance Office of America, shared his actual insurance claims data from insurance companies and our numbers were so close.

But, to most sceptics, not even this is enough. What we need is real data provided by the industry that not only gives insight into the issues we are facing but shows how serious we take the problem. The fact is that each member of the business is going to be evaluated on their own merits and track record. To those that are in the fortunate position to self-insure, the risk becomes a “cost of doing business,” but to most operators, each operation is precious, and a daily balance of risk and reward is constantly faced.

I spoke with Bryan Staley, president and CEO of EREF, which is leading the major data collection study on fires in our waste and recycling operations in the U.S.: the "Assessment of the Frequency and Cause of Fires at Material Recovery and Scrap Recycling Facilities and Collection Vehicles." EREF has decided to keep the phase one survey open until the end of 2020 in order to increase participation.

“We began this project, in coordination with the Solid Waste Association of North America, the Institute of Scrap Recycling Industries and the National Waste & Recycling Association, because facility fires have an array of implications for solid waste management from both an economic and operational perspective,” he said. “Since we initiated this study, we’ve received 100 percent confidential responses from more than 200 waste, recycling and scrap companies. As part of our mission to produce reliable science and data, we’re working to double that number by the end of the year. I encourage anyone who has not participated to join those who have by contributing data to this valuable research study.”

A similar study has been convened by a waste and recycling industry consortium across the pond organized by Eunomia. According to Eunomia, “the purpose of the project is to establish the costs of, and recommend measures to prevent, fires started by lithium-ion batteries (LIBs) in waste. Final findings and recommendations are due to be published in a report in the new year, but initial indications are that hundreds of these fires occur every year (as many as one every two days), costing the fire service, society, the environment and waste management companies millions of pounds each year. As well as quantifying the problem, our report aims to influence local and national government to put measures in place to help keep LIBs out of the wrong waste streams and stop the spread of flames.”

Sophie Crossette, a project leader at Eunomia, said: “The average person in the UK throws away 23.9kg of electronic waste every year. The costs associated with clearing up damage to equipment and buildings caused by waste fires are huge—even when in the correct waste stream, the average cost to the waste electrical and electronic equipment (WEEE) industry of each individual fire incident is estimated at £173k, with more severe fires costing on average £1.2 million. What we don’t yet know is the costs of these lithium battery fires in municipal waste and recycling, including those to the taxpayer, fire service and environment. This is why we have come together with industry to better understand the issues and suggest what can be done to prevent more fires.”

Conclusion We are all in this together. As an industry we are all on the front lines fighting to remove hazards from our waste and recycling streams, but we all know that it is not that simple. We need to continue to educate the public on proper disposal and recycling techniques. For our industry to remain financially healthy, we need a solid group of insurance companies to help allocate any catastrophic risks across their portfolio base. With that I ask and promise that filling out EREF’s confidential survey will not cause insurers to leave our occupancy but will show them we are talking our risks seriously and focusing on keeping our industry as safe and fire free as possible. Not only will this survey provide invaluable data for all of us to learn from, it provides the real costs that we face to all of the producers of the hazards that in my opinion need to be held responsible for some of the costs and supply chain complexities their products cause during disposal and recycling. If you operate a MRF, transfer station, scrap metal facility or other recycling operation, please take next twenty minutes to fill out the survey. If you have multiple facilities, EREF offers an excel spreadsheet that can be utilized to save time. Continue to stay diligent and safe!

Ryan Fogelman, JD/MBA, is vice president of strategic partnerships for Fire Rover. He is focused on bringing innovative safety solutions to market, and two of his solutions have won the distinguished Edison Innovation Award for Industrial Safety and Consumer Products. He has been compiling and publishing the “Reported Waste & Recycling Facility Fires In The US/CAN” since February 2016 and the “Waste & Recycling Facility Fires Annual Report.” Fogelman speaks regularly on the topic of the scope of fire problems facing the waste and recycling industries, detection solutions, proper fire planning and early-stage fire risk mitigation. Additionally, Fogelman is on the National Fire Protection Association’s Technical Committee for Hazard Materials. (See: https://www.linkedin.com/in/ryanjayfogelman/)

About the Author

You May Also Like